Macquarie says rooftop solar juggernaut is unstoppable

By Giles Parkinson on 12 February 2013

In an analysis that broadly reflects the conclusion of UBS energy analysts about how rooftop solar PV is heralding an energy revolution, Macquarie notes that many existing fossil fuel generators in Germany are losing money and could go out of business. And even steep subsidy cuts to renewables would not reverse the trend.The fundamental transformation of energy markets brought about by the growing incursions of renewables such as wind and solar has been underlined in a new report by the European energy analysts at Macquarie Group, who have concluded that the plunge in costs for rooftop solar PV has fallen to such an extent that its continued rapid deployment may be unstoppable.

“Traditional wisdom suggests that steep subsidy cuts can bring the solar build-out under control again,” the Macquarie analysts note. “We disagree, though, as the ever-increasing prices for domestic and commercial customers as well as rapid solar cost declines have brought on the advent of grid parity for German roofs. Thus, solar installations could continue at a torrid pace.”

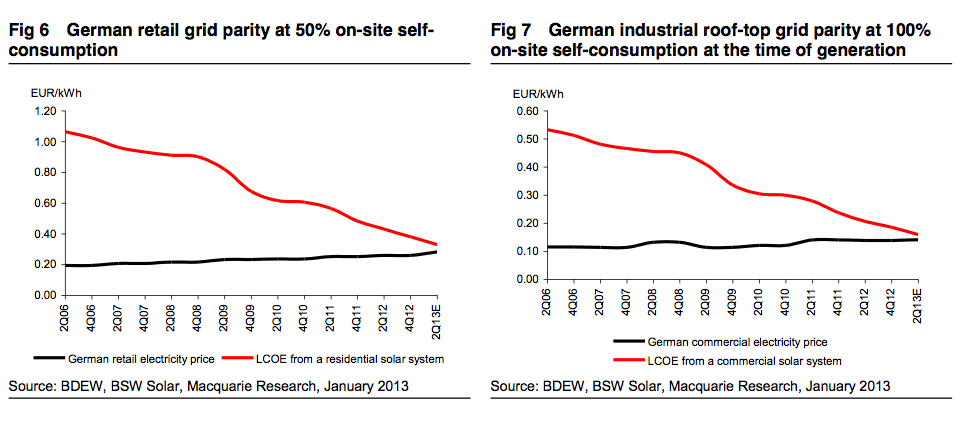

Here are some key graphs to illustrate its point. Macquarie notes that wholesale prices in Germany have fallen 29 per cent over the last five years, while retail prices have risen 31 per cent – both movements at least partly due to the impact of renewables. But those movements pale in comparison with the dramatic fall in the cost of rooftop solar PV.

(If the graph is partly hidden in your browser, please click it to see it in full).

Macquarie says rooftop solar generation in Germany currently costs between €0.12kWh and €0.14/kWh (assuming 85 per cent debt financing and 4 per cent interest rate). These compare favourably with retail grid electricity prices of €0.28/kWh (even at just 50 per cent on-site self-consumption). But solar PV can even offer savings at industrial and commercial grid prices which are even lower at €0.11-0.17/kWh.

“Consequently, solar installations could continue at a rapid pace even without subsidies,” Macquarie notes. “Ultimately, this would threaten the role of coal-fired generation as the price setter in wholesale power price formation.”

No comments:

Post a Comment